Hightlights: FY 2015-16 Standalone

₹36,202Crores

Net Turnover

₹5,723Crores

EBITDA

7.5%

Weighted average cost of debt as on March 31, 2016

₹7.50Per Share

Equity Dividend

JSW STEEL AT A GLANCE

JSW Steel is the flagship company of JSW Group, part of the O.P. Jindal Group. JSW Steel is among the world’s most illustrious steel companies, and is India’s leading primary integrated steel producer.

JSW Steel has plants located across six strategic locations in South and West India, namely, Karnataka, Tamil Nadu and Maharashtra. Our strategy of always staying on the leading edge of technical advancement has led to partnerships with global sector leaders; and has helped our plants rank among the world’s lowest-cost steel producers.

Key Metrics

18 MPTA

Steel - making capacity

6th

Position among worldclass global Steel makers as per WSD in 2016

Hightlights: FY 2015-16 Standalone

12.56 MT

Crude Steel Production

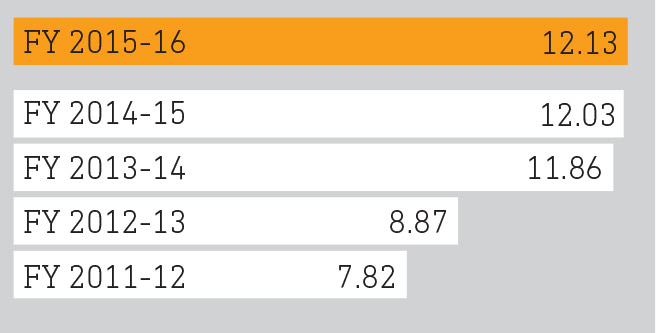

12.13 MT

Saleable Steel Sale

₹40,345Crores

Gross Turnover

WIDE PORTFOLIO OF PRODUCTS

We offer the widest product portfolio in India and leverage our capabilities to customise offerings to fulfil specific customer needs. We are a pioneer in the use of innovative technology that keeps us ahead of competition.

-

Hot Rolled

Cold Rolling & Galvanizing, Drawing & Press Forming, Electrical Stampings & Forming, Welded Tubes & Pipes

-

Cold Rolled

Automobile, White goods, Cold Rolled formed sections, Drums & Barrels, Furniture

-

Galvanized

Roofing and Cladding, Ducting, Boxes, Coolers, Furniture, Heat Plates, Solar Heating Panels.

-

Colour Coated Products

Roofing, White goods, Appliances, Automobile bodies, Cladding etc are the main application

-

Galvalume

Roofing and Cladding, Ducting, Boxes, Coolers, Furniture, Heat Plates, Solar Heating Panels

-

Electrical Steel

Rotating Machines, Motors, Home Appliance, Fan, Power Transformer, Reactor, Magnetic Switches

KEY PERFORMANCE INDICATORS

-

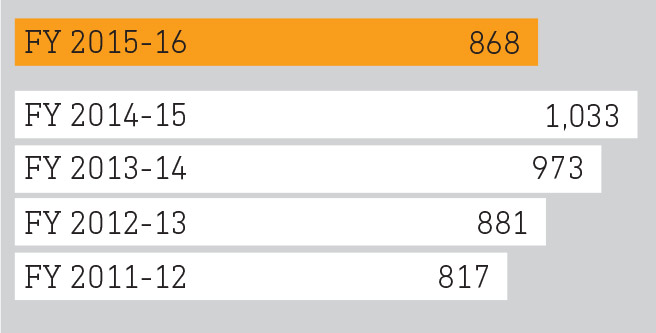

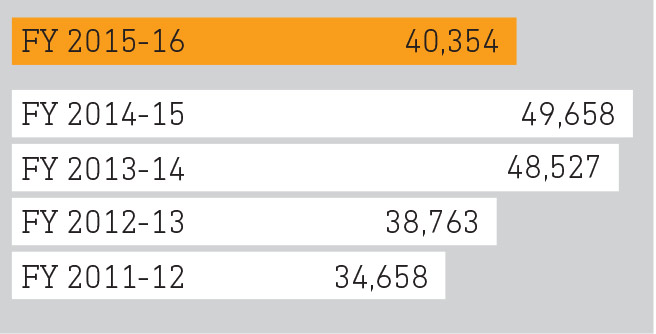

Gross Turnover

(in ₹ crores)

Gross Turnover declined due to decline in realisations

-

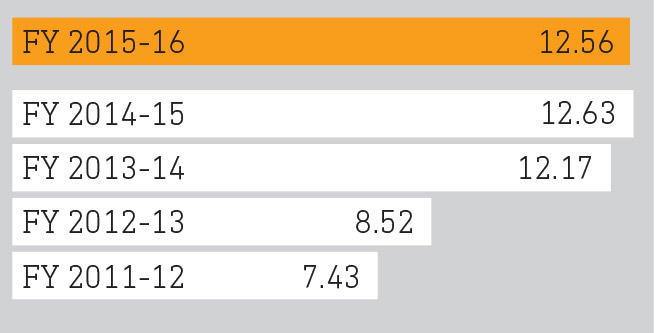

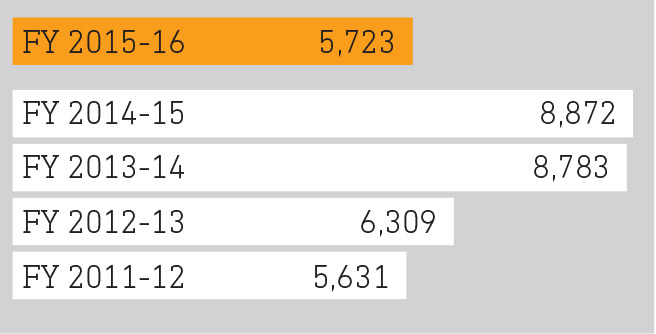

Operating EBITDA

(in ₹ crores)

Higher production/plant utilisation and reduced cost of production contributed to a favourable EBITDA

-

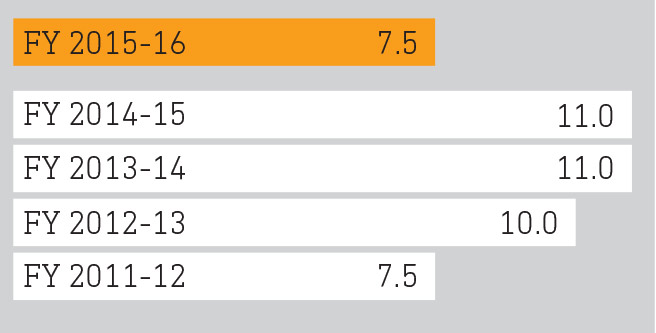

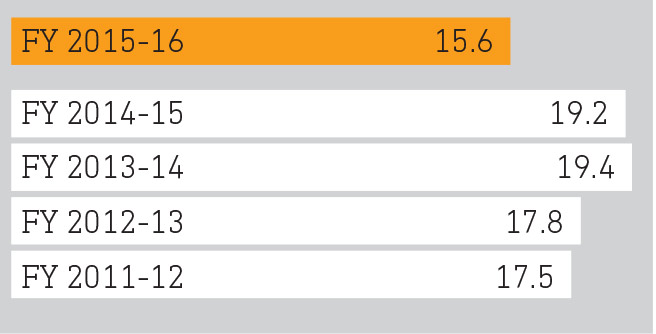

Operating EBITDA Margin

(%)

Operating Margin is lower mainly due to drop in realisations due to predatory pricing of imports

-

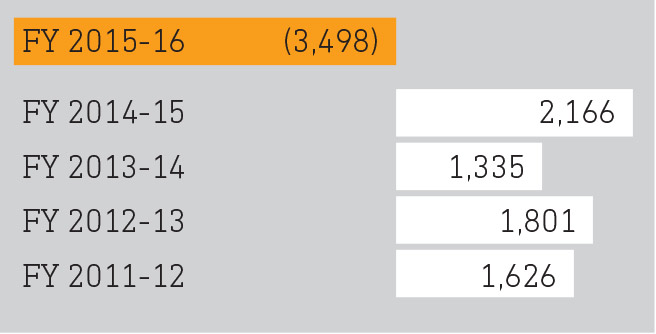

Profit After Tax

(in ₹ crores)

The Company posted a Net Loss due to provision for diminution in value of investments and loans and advances

-

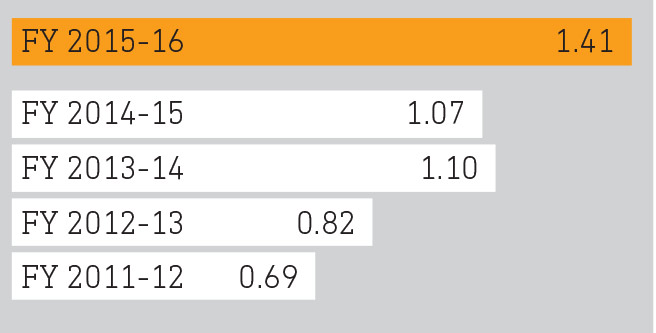

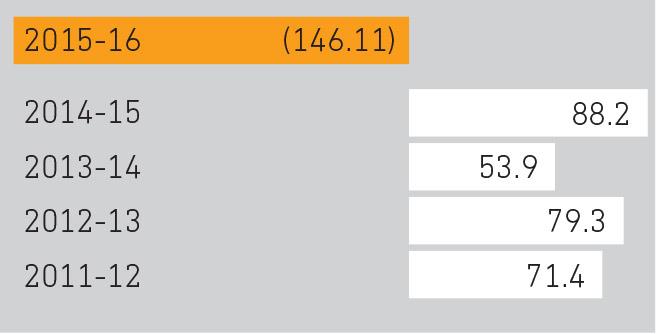

Earnings Per Share

(in ₹)

In line with profitability

-

Contribution to Government & Society

(in ₹ crores)

5 years CAGR 14.3%

Gross Fixed Assets

(in ₹ crores)

Capacity expansion up to 18 million and additions of value-added steel manufacturing facilities

Adjusted Debt Equity Ratio