While our peers faced financial challenges, we have consistently maintained a strong Balance Sheet. With the easing of interest rates and a reduction in debt, we are now suitably positioned to invest in our future growth. Our continuing competitive advantage is the result of the judicious business decisions taken when faced with challenges or bursts of cyclical opportunities.

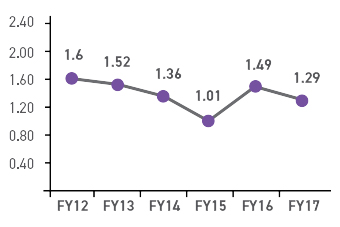

Our plant performances have time and again reiterated our operational strength, further fortifying our financial strength. Our net debt to equity ratio of 1.29 provides us with sufficient headroom to explore market opportunities that are low on risk and high on long-term value creation. We are conscious of the value we create for our stakeholders. Thus, JSW Energy aims at increasing the power generation capacity to 10,000 MW in the long-term through both organic and inorganic means.

| Key Financial Parameters | FY2014-15 | FY2015-16 | FY2016-17 |

|---|---|---|---|

| EBITDA Margin (%) | 40.1 | 42.4 | 41.8 |

| Return on Avg. Net Worth (%) | 19.2 | 16.8 | 6.3 |

| EPS (` Per Share) | 8.23 | 8.90 | 3.86 |