Better Everyday

At JSW Steel, we believe that excellence is a moving target. From profitability to sustainability, we are constantly setting benchmarks and strive to outdo ourselves, every day.

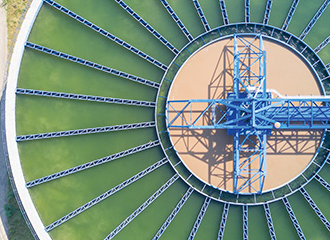

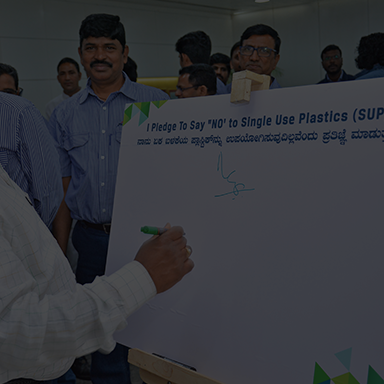

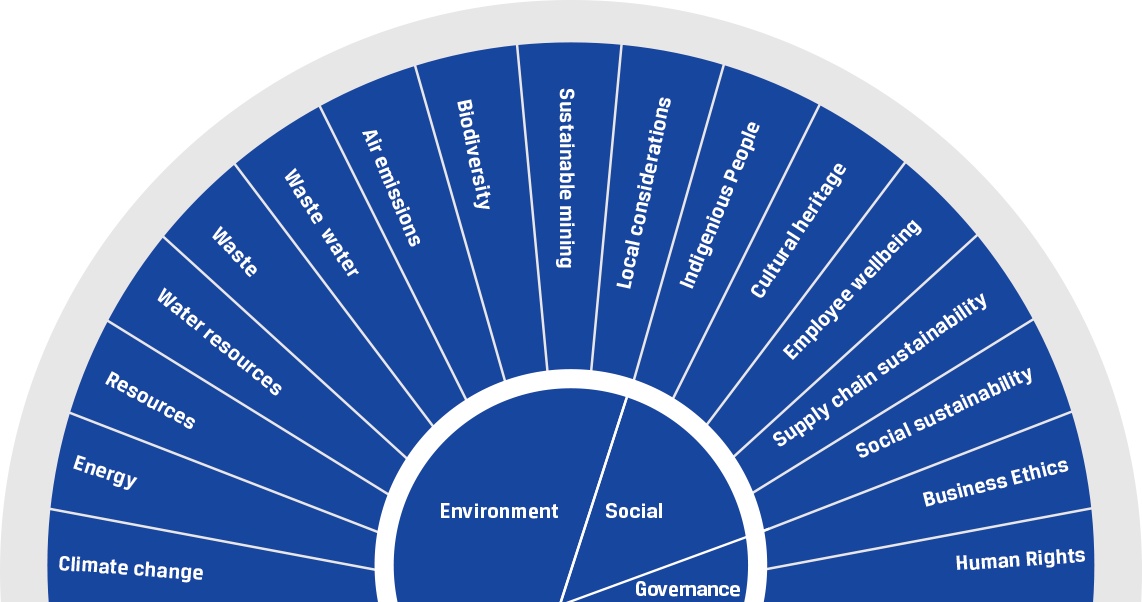

Our commitment to be ‘better’ is reflected in our journey to be more responsible, more efficient and more value-driven. Together with our business objectives, we nurture an unwavering ESG focus, which guides every decision we make and every action we take.

As we gear for a new and dynamic era for India and the world, we believe that our efforts towards being better every day will drive lasting value for all our stakeholders, and usher in a stronger tomorrow for everyone.