STRATEGIC FOCUS AREAS > S3

BACKWARD INTEGRATION AND RAW MATERIAL SECURITY

S3

BACKWARD INTEGRATION AND RAW MATERIAL SECURITY

Securing captive sources of iron ore and coal is an integral part of our long-term raw material security plan. We currently possess 13 iron ore mines (nine in Karnataka and four in Odisha), which can significantly support our raw material requirements.

Material issues

M4 Raw material security

M15 Logistics efficiency and supply chain management

M24 Sustainable mining

M12 Profitability

Strategic drivers and operating context

Two of the most important raw materials for the production of steel are iron ore and coking coal.

India is the fourth largest iron ore producing country in the world. More than 95% of deposits are concentrated in Odisha, Karnataka, Chhattisgarh, Goa and Jharkhand. Indian steel plants either source the material from their own captive mines located in these regions or purchase the same from players such as National Mineral Development Corporation (NMDC) and merchant miners, or from other countries.

Domestic steelmakers operating with captive iron ore mines are better positioned because of assured raw material supply mined at a calibrated cost. For others, the dependency on external providers increases their raw material supply risk and is subjected to higher costs of operations.

In 2013, the Supreme Court of India directed the Karnataka government to cancel 51 ‘C’ category leases (mines that illegally operated in more than 15% area outside their lease boundaries) and to re-allot them to end users through a transparent bidding mechanism. The first round of auctions happened in 2016 and of the seven mines sold through online tendering by Karnataka, JSW Steel received six mines.

In line with the Mines and Minerals (Development and Regulation) Amendment Act, 2015, the Odisha state government recently announced the auction of 20 iron ore mines, whose licences were expiring in March 2020. As a result, 17 mines (12 merchant mines and five for captive use) were successfully auctioned with active participation from 86 bidders. Among these, JSW Steel bagged four mines (two merchant mines and two captive mines), gaining control of ~21% of Odisha’s total merchant iron ore supplies.

For coking coal, India depends heavily on imports from a select number of countries, such as Australia, the US and Canada. Availability of quality grades, erratic price movements from domestic suppliers etc. are the primary reasons for the high import bill.

Taking note of this challenge and to reduce pricing and concentration risks, the Government of India is taking relevant measures to reduce imports, keep a tab on domestic prices and explore alternative overseas sources for coking coal.

Action plan

A significant step towards iron ore security

We have maintained our cost leadership in the past with a core focus on efficiency. With the recent acquisition of mining licences in Karnataka and Odisha, we expect a significant increase in the overall operating profitability, going forward. However, with the operationalising of our existing mines in Karnataka and the recent acquisition of four mines in Odisha, the iron ore supply chain scenario has turned in our favour. With this shot in the arm, we are set to progress with an even better EBITDA per tonne and long-term security.

The Karnataka scenario

We operate our single largest plant at Vijayanagar, located in Karnataka’s Ballari region. Hence the supply and demand equation of iron ore in the state plays a huge role in determining our overall cost competitiveness, margins and raw material security.

THE DEMAND SIDE

JSW Steel Vijayanagar Works, with a 12 MTPA installed capacity, is the largest steel plant in the state and requires ~23 MnT of iron ore to service its requirements. Other players together demand ~12 MnT for their operations. Together, the requirement is ~35 MnT within the state.

IRON ORE DEMAND IN KARNATAKA – FY 2019-20

THE SUPPLY SIDE

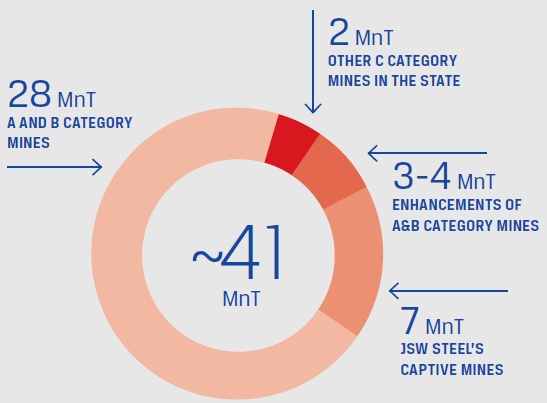

There are three categories of mines that produce iron in Karnataka. The A and B categories, operated by private miners, can produce up to 35 MnT annually, as per the cap prescribed by the Supreme Court. Since the Donimalai mines of NMDC are currently not in production, the total production from all other A and B category mines was around 28 MnT in FY 2019-20. In addition to these, some mines are undergoing enhancements and they are expected to contribute another 3-4 MnT to the overall supply, totalling up to a conservative estimate of around 32 MnT of production from A and B category mines.

JSW Steel is producing close to 7 MnT of iron ore from its nine captive iron ore mines. Additionally, those miners who have taken C-category leases are bound by agreement to produce at least 2 MnT in FY 2020-21. Together with the A and B categories, the total iron ore supply will thus be around 41 MnT.

Note: All figures are as per internal approximations.

EXPECTED IRON ORE SUPPLY IN KARNATAKA – FY 2020-21

The above scenario creates a conducive input cost environment for steelmakers such as JSW Steel, with overall supply of iron ore exceeding demand by at least 7 MnT.

OUR APPROACH

In line with our expansion plan, Vijayanagar Works is expected to reach a total of 18 MTPA capacity in the medium term. Post expansion, the plant will require ~33 MnT of iron ore to service annual requirement. Considering other players maintain their current demand, the total requirement of the state would go up to ~45 MTPA.

This scenario would reverse the current supply-demand trend and would exert cost pressure on steelmakers such as us. Hence, it is imperative that newer leases are brought into the picture. And, as a large player with a clear strategy, we are well poised to take on newer mines and streamline them with our operations.

The Odisha scenario

Our Dolvi and Salem plants rely on the Eastern belt and imports to service their iron ore requirements. The recent mine auctions in Odisha, which saw us win four mines, have created a paradigm shift in our way forward.

THE DEMAND SIDE

JSW Steel Dolvi Works is a 5 MnT steel plant that requires ~9 MnT of iron ore to meet its raw material needs. The plant is undergoing a capacity expansion and within FY 2020-21, is expected to commence operations with an additional 5 MTPA crude steel capacity, thus requiring ~18 MnT of iron ore annually.

The pellet and DRI operations at Dolvi and associated Salav Works require high-grade iron ore for their special products. Currently, we source this material from NMDC to the tune of 3-4 MTPA. The rest of the requirement has been historically serviced by either private mines in Odisha or via imports, depending on the landed cost. During FY 2019-20, we serviced the entire requirement from Odisha, in light of better prices.

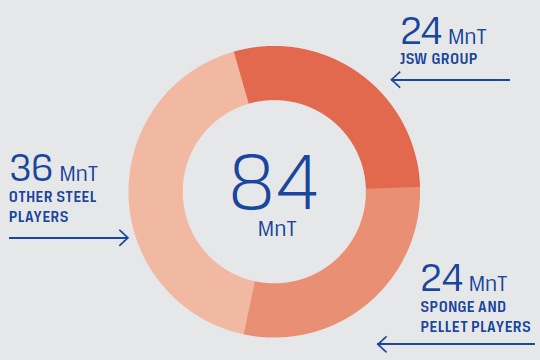

OPEN MARKET IRON ORE DEMAND IN ODISHA – FY 2019-20 (PRE-AUCTION AND CAPTIVE PRODUCTION)

25 MnT

FY 2020-21 (POST AUCTIONS AND CAPTIVE PRODUCTION)

Indian steelmakers source on an average ~84 MnT of iron ore from Odisha every year. Until last year, this could be broken up as JSW Group (JSW Steel, its subsidiaries and associates) taking ~24 MTPA, other major steel players taking ~36 MTPA and sponge and pellet players procuring ~24 MTPA. However, with the recent mine auctions, the situation has swung in favour of supply as at least 50 MTPA captive production is expected to emerge in the near term by auction winners. Of this, JSW Steel is expected to produce ~24 MTPA. This, together with any other captive producers going out of the market, leads to open market demand being starkly reduced to ~25 MTPA from FY 2020-21 onwards.

THE SUPPLY SIDE

At a market level, we expect ~37 MTPA to be produced for the open market by the merchant miners, from FY 2020-21 onwards. Apart from the captive mines won by steelmakers, few merchant miners also emerged as winners of certain mining blocks. In line with the terms of lease, the key merchant miner among them is expected to produce ~12 MnT from next year onwards. Hence the total supply in Odisha is expected to be at least ~49 MTPA. This is substantially higher than the expected average demand.

For JSW Steel, the mines allotted are a mix of both captive and merchant leases, with reserves to the tune of 1.2 billion tonnes and an annual production capacity of ~28 MTPA. The production from merchant mines owned by JSW Steel and other steelmakers may exceed their own captive demand and it’s highly likely that their excess produce will be sold in the market, which would further increase the overall supply of iron ore in Odisha.

OUR APPROACH

Until recently, we were highly dependent on different merchant miners for various grades of iron ore. This prevented us from undertaking any significant capex to achieve logistics efficiencies as the movement of goods was not specific. However, with the availability of captive mines, we are actively evaluating possibilities to significantly enhance logistics efficiency as well.

Hence, the mine acquisition in Odisha is a game changer for us at JSW Steel. With this, we have now secured long-term raw material security, consistent quality and overall control of our iron ore supply chain. It further strengthens our position as a cost-efficient player in the global market.

Key metrics

4.11 MnT

IRON ORE FROM CAPTIVE SOURCES

1,011 MW

TOTAL CAPACITY OF CAPTIVE POWER PLANTS

Key risks

R3 Raw material availability and cost

R4 Regulatory and compliance

R11 Environment protection and climate change

R12 Occupational health & safety

R14 Local communities

Smart and sustainable mining

JSW Steel is known as a trendsetter in the Indian steel industry. We are now implementing practices and installing systems to set the bar higher in the mining space.

DIGITAL MINING

JSW Steel is the only mine operator in Karnataka to have instated an end-to-end digital mining ecosystem. Every mining operation is digitally managed by key personnel on a tablet. The direction and load of the entire fleet are also controlled digitally. With the success of this model in Karnataka, we are now taking our expertise to the mines in Odisha as well.

SUSTAINABLE MINING

Our mining operations are strictly led by the mining plan submitted and approved by the Indian Bureau of Mines. We undertake fully scientific and environment-friendly mining practices, starting from topography development of the C-category mines. We are also engaging larger and high-capacity equipment, which lead to both scale and safety. Further, to transport material in an incline, we are currently installing a downhill conveyor, which significantly reduces the dust and other nuisances that may hinder community life around the sites.

Maintaining an optimal coal sourcing mix

With regard to coking coal, Indian steelmakers are largely dependent on imports. While development of coal blocks in India is underway, several factors have pulled back its progress.

For Asia, the coal scenario is also driven by the fact that coal consumption for many developed countries have become minimal, reducing their overall demand. This augurs well for India, which is dependent on external sources as opposed to China, which has developed domestic coal reserves.

Globally, the mining industry is controlled by a key set of suppliers, who keep the demand tight with buoyant pricing. These suppliers span select geographies, which are subject to various weather aberrations as well. Hence, to reduce supply risk and concentration risk, we actively pursue a diversified sourcing strategy.

To achieve this purpose, we have developed specific countries as suppliers in the past, such as Mozambique and Indonesia. We are also consistently exploring other regions for coking coal supply to enhance our raw material security adequately.

At JSW Steel, we maintain a dynamic blend management system and enter into yearly contracts with suppliers to ensure that we receive a consistent quality of various grades of iron ore from a specific set of providers.

OUTLOOK

Near-term

Operationalise the three recently acquired mines in Karnataka

Operationalise all four mines received in Odisha auctions

Commence the expansion of Paradip port for capesize vessels

Evaluate and develop a slurry pipeline in Odisha, connecting Nuagaon mine with Paradip port

Long-term

Participate in the government's iron ore and coal auctions to improve backward integration

Evaluate opportunities to increasingly use domestic coal and continue diversification of coal sources

Target to source up to 50% of iron ore requirement captively