Powering India’s Future. Better Everyday.

Over the past few years, the power sector in India has been one of the largest contributors to the country’s stressed assets. The total outstanding debt of stressed power assets to banks amounts to around `1.7 trillion, largely attributable to power assets held by the private sector. Various challenges faced by the private sector power capacities include lack of power purchase agreements, stretched capital structure due to time and cost overruns in the project, non-availability/short-availability of domestic coal, constraints in coal evacuation infrastructure and weak financial health of the state distribution companies.

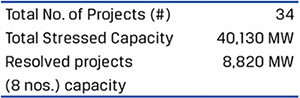

As per the Government reports, around 34 projects with a total capacity of ~40 GW, largely in private thermal sector were under stress.

Over the last two years, power demand growth has been robust. It grew by 6.2% and 5.0% in FY2018 and FY2019, respectively. On the supply side, the pace of capacity addition has been shedding momentum over the last two years, along with retirement of old and inefficient capacities in a phased manner. In the last two fiscal years, ~5.2 GW of thermal capacity retired, predominantly from the State sector, and this trend is likely to continue for the next few years.

With a base demand of 160 GW and an expected power demand growth of 5-6% per annum, the incremental annual adjusted demand is expected to be ~10-12 GW, which should absorb the existing excess capacities in another two years through consolidation.

Further, various sectoral reforms and initiatives for resolution of stress in the sector have been undertaken by the Government such as Insolvency and Bankruptcy Code (IBC), SHAKTI Policy, PPA Pilot Scheme, Power for All, etc. Government measures of following competitive bidding procedures for procurement of power will create a level playing field for the private players. Additionally, strong production growth in the Indian domestic coal (7.3% in FY2019) is expected to moderate the fuel supply constraints, especially for the private sector players.

The stressed environment in the Indian power sector offers exciting inorganic growth opportunities to existing power sector players such as JSW Energy that has a robust balance sheet and the financial headroom to capitalise on these opportunities for meeting growth aspirations. We aim to meaningfully participate in the consolidation opportunities in a prudent and calibrated manner. We will be looking for such assets where the cost of power generation will be low and thus placed competitively in the merit order dispatch.

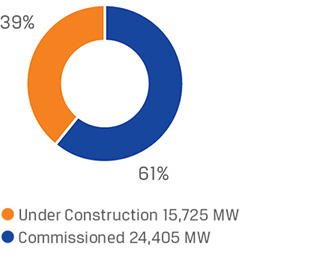

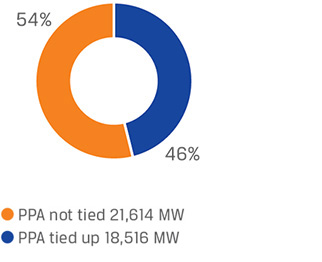

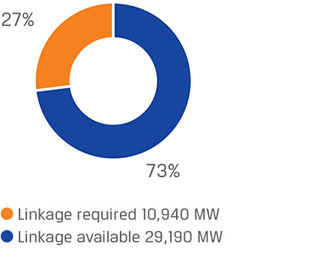

Break-up of Total Stressed Capacity*: 40,130 MW

* Source: Report of the High Level Empowered Committee to Address the issues of Stressed Thermal Power Projects (November-18)