Performance by Capitals

Financial Capitals

At JSW Energy, the robustness of our financial capital is essential to our operational success. Over the years, we have leveraged our strong financial capital to invest in business expansion to sustain market leadership. To create sustainable value for all stakeholders, we manage our financial capital in an astute, optimum and diligent manner, thereby harnessing opportunities for long-term value creation. We are among the few power-generating companies in India with strong revenue growth that bolsters our future growth strategies. We have been able to demonstrate a progressive financial performance over the years.

Our financial capital inputs are majorly to fund our capacity expansion, operational expenses, repayment of principal and interest on debts and strategic acquisitions.

Performance Snapshot

Our stable financial performance is

the result of the business decisions

we have taken over the last few years

and our operational efficiency. Our

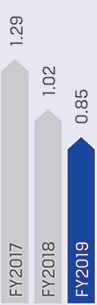

consolidated Net Debt to Equity ratio

substantially improved over the years

from 1.29x in FY2017 to 0.85x at the

close of FY2019. This was achieved

through proactive prepayments,

scheduled repayments and intensive

working capital management.

Our debtor days slightly increased by six days over the previous year’s level of 50 days and the receivables level increased by `276.53 Crore. Owing to increase in Marginal Cost of Funds based Lending Rate (MCLR) by the Reserve Bank of India (RBI), there was a general increase in interest rates due to which our weighted average cost of debt slightly increased by 4 bps during the reporting year.

Key Performance (Consolidated) Highlights and Outcomes

Revenue (` in Crore)

9,506

During the last two financial years, JSW Energy recorded 5.87% CAGR in revenue, which has been majorly driven by revenue from sales of power.

Revenue from sale of power increased from `7,711 Crore in FY2018 to `8,794 Crore in FY2019, with y-o-y increase of 14.05%.

Revenue from sales of services increased from `163.23 Crore in FY2018 to `169.58 Crore in FY2019, with y-o-y increase of 3.89%.

Our focus for the next year is to continue the growth momentum in our core business and investments in diversified portfolio for sustainable growth.

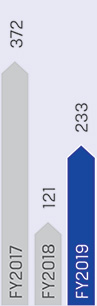

CAPEX (` in Crore)

233

There has been an y-o-y increase of 93.33% on cash outflows in capital expenditure (capex) for upgrading our facilities in the areas of technology, automation, safety, environment and systems.

With an aim of diversifying into cleaner energy, we expanded our portfolio in the RE segment in FY2019, with an investment of `43.81 Crore for setting up solar power systems.

PAT (` in Crore)

695

PAT in FY2018 was lower at `77.97 Crore owing to one-time exceptional item of `417.94 Crore towards the loss allowance on certain loans.

EBITDA (` in Crore)

3,221

Net Debt (` in Crore)

10,050

Net Debt to Equity (Ratio)

0.85

Return on Equity* (%)

5.88

Equity to EBITDA (Ratio)

3.67

Net Worth (` in Crore)

11,822

Return on Equity* (ROE) improved substantially at 5.88% in FY2019, compared to the previous year’s return of 4.46%.

Net Debt to Equity reduced to 0.85x in FY2019 from 1.29x in FY2017.

PAT and Equity/Net Worth wherever reported in this Report are attributable to the owners of the Company. * PAT before exceptional items.