Powering India’s Future. Better Everyday.

JSW Energy has one of the strongest balance sheets in the power sector. At a time when most of the power sector players have been adversely affected by volatile sector dynamics, JSW Energy has been unscathed and resilient, supported by its balance sheet strength and prudent financial policies, thereby protecting value for all its stakeholders.

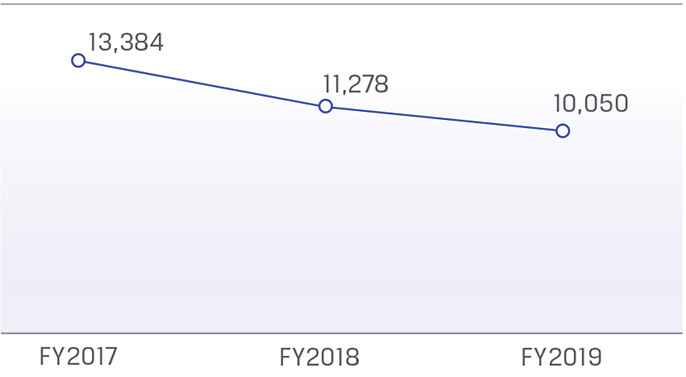

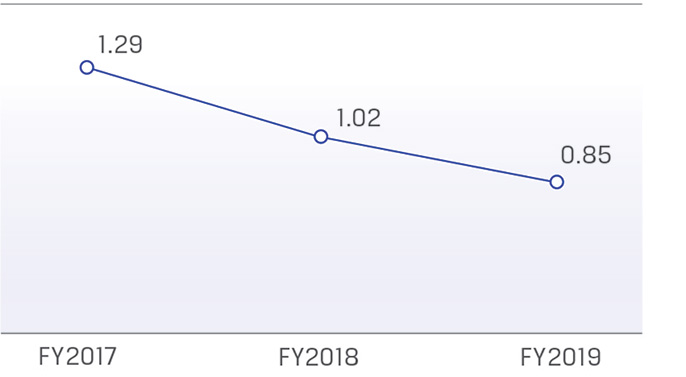

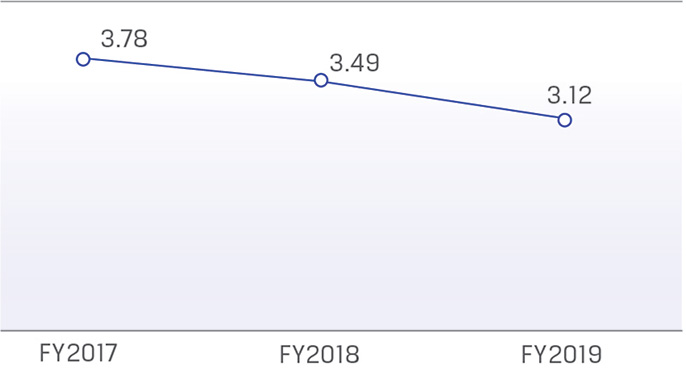

Over the past two years, the Company has proactively reduced its net debt levels by `3,334 Crore. As on March 31, 2019, the consolidated Net Debt to Equity ratio of the Company stood at 0.85x while the consolidated Net Debt to EBITDA stood at 3.12x, both significantly lower than the industry average. In FY2019, Gross Cash Accruals^ remained healthy at ~`1,892 Crore which significantly aided in balance sheet strengthening. This improvement in financial risk profile was acknowledged by credit rating upgrade of our subsidiary JSW Energy (Barmer) Ltd. to ‘AA-‘ from ‘A+’ and outlook revision of JSW Energy to ‘Stable’ from ‘Negative’. With proactive refinancing and sequential improvement in the credit rating of its subsidiaries, JSW Energy’s weighted average cost of debt reduced by 110bps in the last two years. Further, JSW Energy has been astutely managing its working capital, thereby ensuring a tight control on its operating cash flows.

The Company has always focused on striking a balance between growth aspirations and risk management, following sound capital allocation principles and robust balance sheet management. This has helped us in managing through down-cycles while at the same time enabling sufficient headroom to meet our long-term growth objectives.

Net Debt (` in Crore)

Net Debt to Networth (Ratio)

Net Debt to EBITDA (Ratio)

Note: All figures pertain to Consolidated Financials of FY2019. ^ Computed as PAT + Depreciation + Deferred Taxes